What is Wire Fraud?

Wire Fraud is:

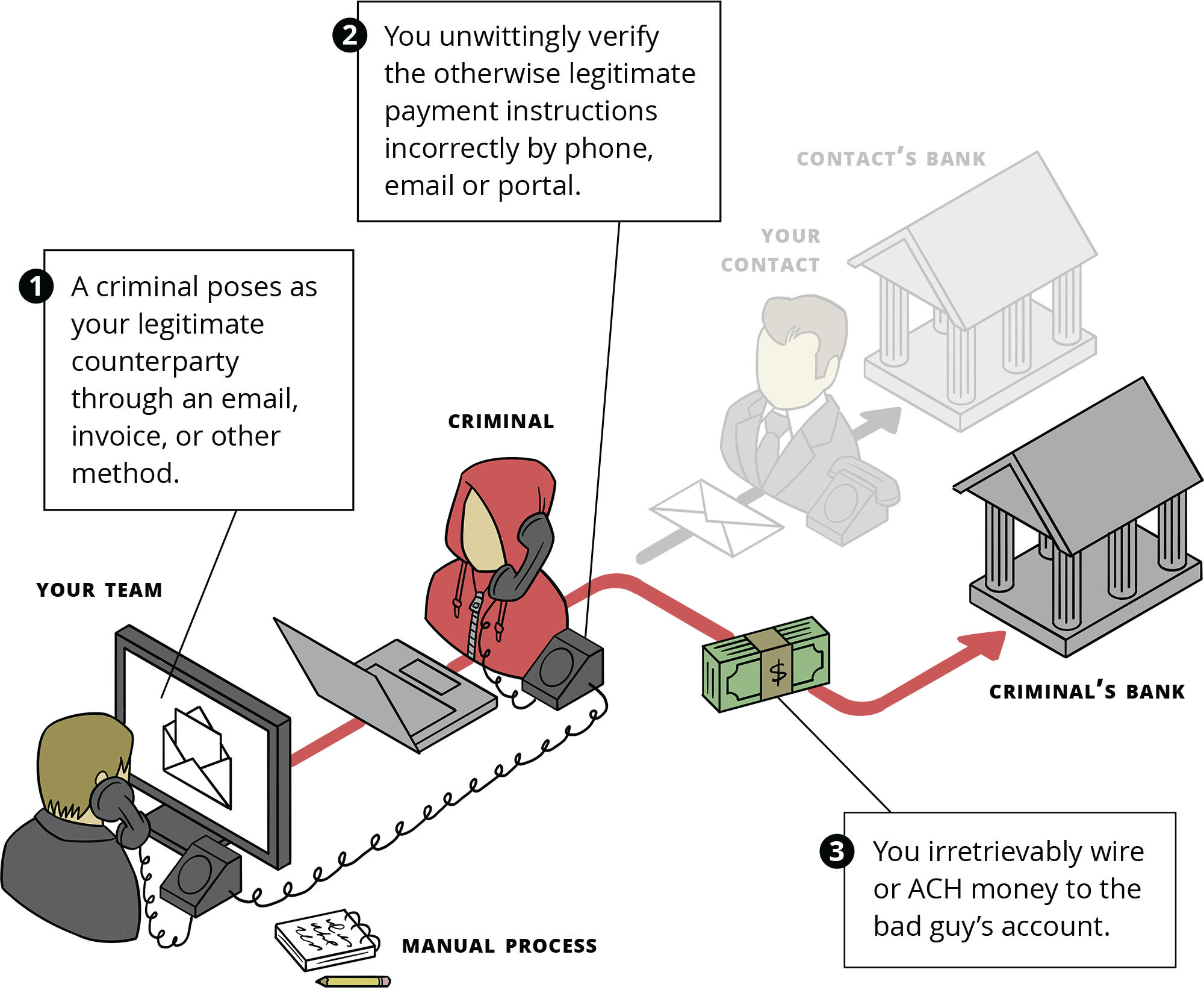

When an organization is tricked to WILLINGLY send a payment to a criminal instead of their intended recipient. The transfer passes all internal approvals, has proper authorization from the bank, and you voluntarily release the funds.

The loss is due to social engineering, not a hack!

Why Wire Fraud is a Problem

Social Engineering, Not Hacking

Criminals know the easiest way to make money is through social engineering. They have an array of tricks, tactics, and tools to misdirect an otherwise perfectly legitimate payment. These social engineering techniques means that wire frauds are due to a failure of people and processes.

You are Responsible to Verify Bank Details

Banks, insurance companies, and service providers provide important protections in transferring funds but are not liable for the wire fraud attacks that happen every day. Whoever hits send on a wire is ultimately responsible if it is directed to a criminal.

Your Team is Not Perfect

Nor should they have to be. Wire fraud happens all the time to the most fastidious, well-meaning, and committed teammates. The bad guys are very “good” at their craft and the payoffs are enormous. A tiny mistake in the face of a sophisticated attack can cost millions.

Losses are Embarrassing and Nobody Shares Knowledge

Along with monetary losses, wire fraud victims also suffer reputational damage. The stigma of being a victim has led to less knowledge sharing among peers, both internal and external.

How to combat wire fraud

Give your team a hand with Conduit.

Request Demo